Recent Webinars

Fraud Alerts

Success stories

1. Starting Your Business

Banking

The first steps are the same for most new business owners: Establish a checking and savings account with a bank you trust. You are an expert in your business field; you don’t have to be a banking expert as well.

Solutions

Building a solid relationship with your banker will help them recommend the right solutions for your business, including cash flow solutions and merchant services depending on your business type.

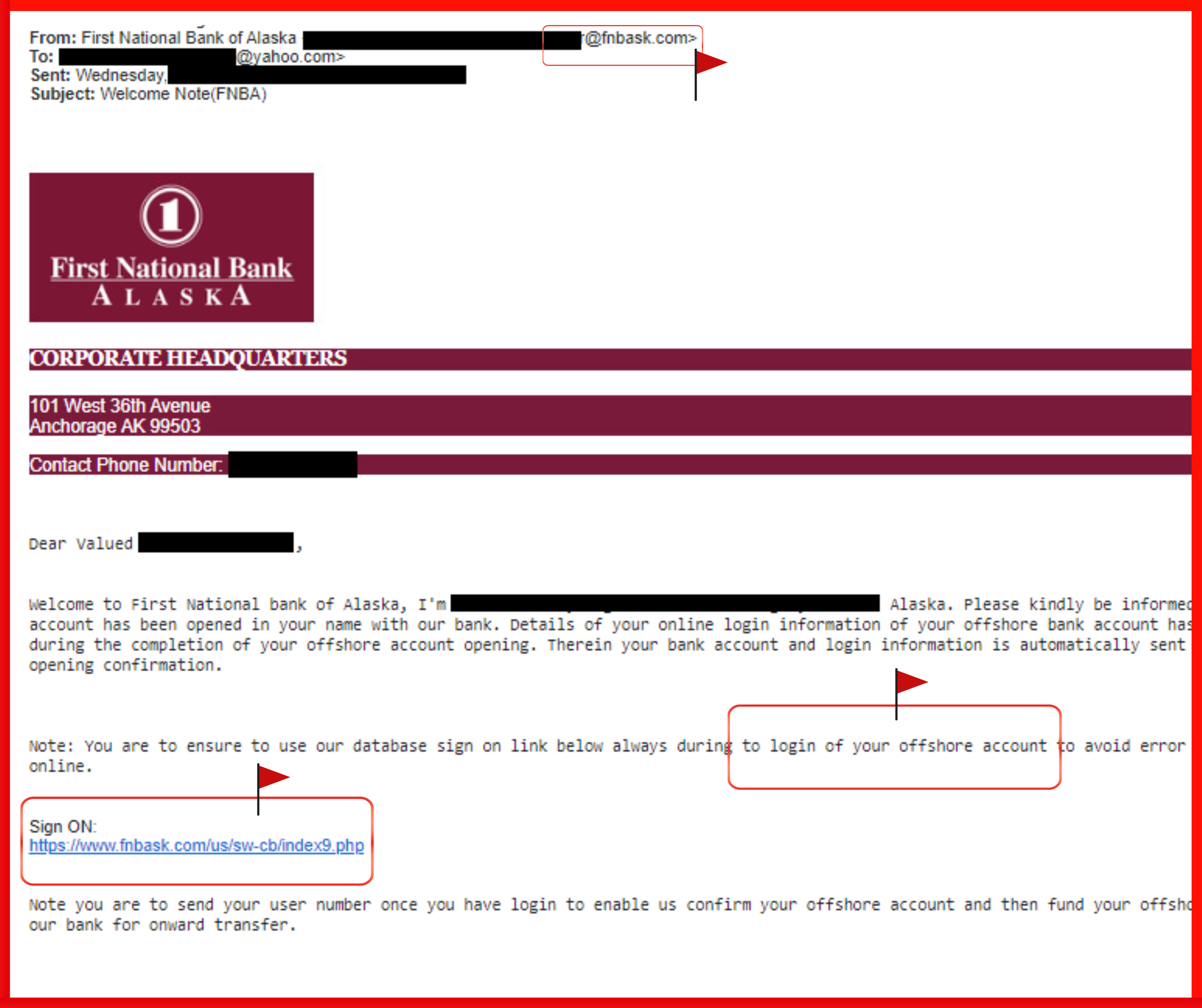

Fraud Prevention

You’re working hard to build your new business. Don’t overlook how to protect it.

2. Growing Your Small Business

Solutions

Taking your business to the next level is about finding the right tools to meet your and your customers’ needs. Digital and online treasury management solutions are where banks house those tools.

Financing

When it’s time to grow your business, cash flow is king. It may be the right time to explore lending options to help you meet your next milestone.

Fraud Prevention

Alaskans lose millions to fraud each year. As your business grows, don’t forget to protect against fraud and scammers.

3. Growing Your Medium to Large Business

Solutions

Taking your business to the next level means finding efficiencies in your processes and tools.

Commercial Financing

Industry-specific lending can help your business with an expansion or construction of your new office, but not all lending is created equal. We recommend talking with your lender about your specific needs.

Fraud Prevention

Corporate-sized businesses face scams from multiple angles. We’re here to help.

4. Reinvesting your wealth and succession planning

Investing in your future

Reinvest your hard-earned funds to maximize your returns. Contact a Wealth Management expert to discuss securing your business’s and your family’s financial future.

- Business Wealth Management and Succession planning

- Individual Wealth Management and Retirement Planning

Investment products are not insured by the FDIC; are not deposits; and may lose value.

Explore Business Topics

Why is Treasury Management important for small businesses?

As a small business owner, you’ll need to send and receive payments, process invoices and payroll, manage liquidity and account access, and so much more. Treasury Management can help you with each of these areas and more.

How can an SBA loan help me meet my goals?

These loans are guaranteed by the U.S. Small Business Administration (SBA), which can help you qualify and improve the loan terms.

When would I need Escrow servicing?

Escrow is a trusted third party that can hold documents, process payments between you and another party, and keep a record of those payments – such as owner/seller-financed transactions.

Streamline your business with an all-in-one merchant services solution

An all-in-one solution such as Clover can do more than securely accept payment. Its platform can help you manage cash flow, track inventory and manage your staff.

Fraud Prevention

Consider using banking tools to help protect your business and customers from fraud.

Positive Pay

Positive Pay helps reduce fraud and protect your accounts by ensuring only the checks you issue are paid.

Check and ACH Block

Check and ACH Block services can help protect your business from unauthorized transactions by automatically stopping all checks or ACH payments from posting to accounts you designate.

ACH Fraud Prevention

Take control of your ACH activity by setting up a list of authorized vendors for ACH debits with filters for authorized amounts, frequencies, and more. Customized text and email alerts on exceptions allow you to quickly make decisions on which transactions to pay or return.

Account and Card Alerts

Help keep your accounts secure by receiving real-time purchase alerts via text and/or email. If you see unauthorized activity in your accounts, contact your bank as soon as possible.

Fraud Prevention Webinar

Watch the webinar to learn how to protect your business in 2024 in this free webinar presented by First National Security Manager James Estes.

No-cost Fraud Analysis

Our fraud experts will provide a complimentary evaluation of your business and the steps you can take to help protect your business from fraud.

Get Support for Your Small Business

We’ll get to know your business and provide tailored recommendations for the solutions to help you shape your tomorrow.