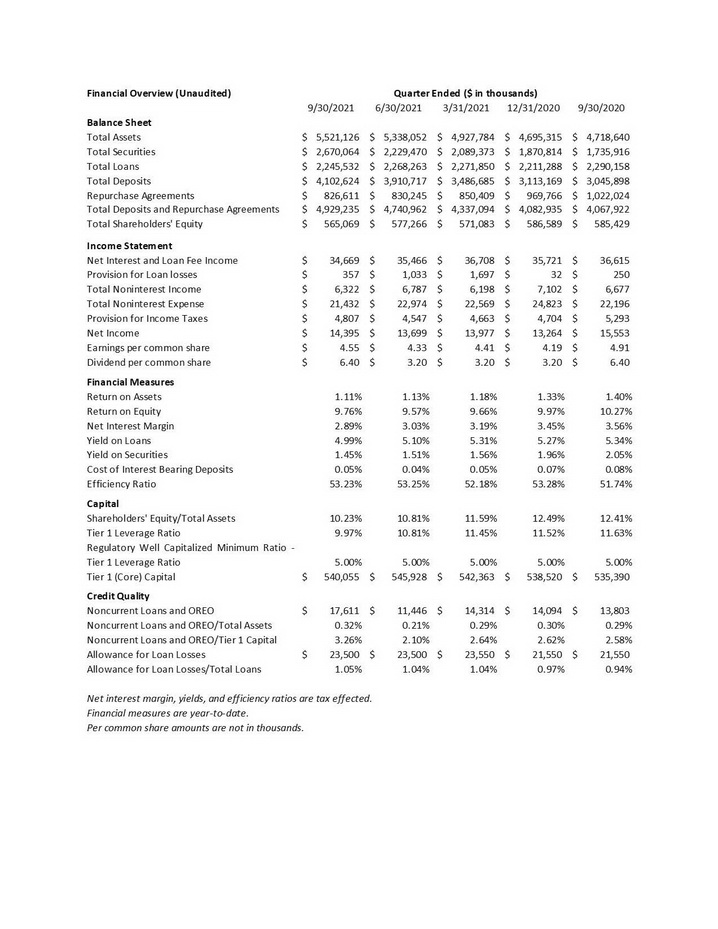

(ANCHORAGE) First National Bank Alaska’s (OTCQX:FBAK) unaudited net income for the third quarter 2021 was $14.4 million, or $4.55 per share. This compares to a net income of $15.6 million, or $4.91 per share, for the same period in 2020. Unaudited year-to-date net income was $42.1 million, or $13.28 per share, compared to $44.3 million, or $13.98 per share for the same period in 2020.

Total interest and loan fee income for the third quarter 2021 was $35.0 million, a decrease of 5.7% from the third quarter 2020 on lower annual yields on earning assets.

The blended yield on interest-earning assets decreased to 2.92% from 3.67% for the nine-month periods ending September 30, 2021, and 2020, respectively. Lower yields on earning assets resulted from variable loan repricing, the addition of Small Business Administration Paycheck Protection Program (SBA PPP) loans, and significant cash and short-term investments. The year-to-date net interest margin moved to 2.89% compared to 3.56% in 2020 on declining yields on earning assets partially offset by decreasing cost of funds.

Noninterest income for the third quarter 2021 decreased 5.3% from the third quarter 2020 as home purchases and refinancing slowed down, causing a reduction in mortgage loan origination income. Noninterest expenses for the third quarter 2021 decreased 3.4% when compared to the third quarter 2020. The efficiency ratio for September 30, 2021 increased to 53.23% compared to 51.74% for the same period last year.

Return on assets for the nine months ending September 30, 2021 decreased to 1.11% from 1.40% for the same period last year on a much larger asset base. Total assets were $5.5 billion as of September 30, 2021, an increase of $825.8 million year-to-date and $802.5 million from September 30, 2020.

Total loans increased $34.2 million year-to-date and decreased $44.6 million year-over-year. Outstanding SBA PPP loans totaled $235.3 million as of September 30, 2021. Through the end of third quarter 2021, First National’s SBA PPP borrowers have received forgiveness totaling $331.2 million and $7.2 million on first and second phase loans, respectively. Deposits and repurchase agreements increased $846.3 million and $861.3 million year-to-date and year-over-year, respectively. This increase was attributed to continuing PPP and CARES Act stimulus to governmental entities and Native tribes, increased savings rates of businesses and individuals, and continued growth from organic business development efforts.

At September 30, 2021 delinquent loans from 30 to 89 days were $1.1 million, 0.06% of outstanding loans excluding SBA PPP loans, a decrease of $1.2 million from June 30, 2021 when delinquent loans stood at $2.3 million. Nonperforming loans were $17.6 million, 0.87% of outstanding loans excluding SBA PPP loans, an increase of $7.8 million from June 30, 2021 when nonperforming loans totaled $9.8 million. The allowance for loan losses at September 30, 2021 was $23.5 million, 1.05% of total loans (1.17% of loans excluding SBA PPP).

Loan modifications as of September 30, 2021 totaled $31.1 million, or 1.6% of total loans, excluding SBA PPP loans. Modification to interest-only payments accounted for more than 73% of the modifications, with interest-only periods ranging from one to eleven months. Modifications were concentrated in hotels, religious organizations, and commercial real estate loans to customers in the rental and leasing industries.

“Alaska’s banking environment continues its dynamic trend, with First National’s deposits growing by $188 million dollars in the third quarter, bringing our total deposit base to $4.9 billion,” said Board Chair and CEO Betsy Lawer. “The notable increase in asset size supports the bank’s mission to help Alaskans succeed, with local banking teams providing unwavering customer support and delivering online tools and resources to meet today’s challenges.”

Shareholders’ equity was $565.1 million as of September 30, 2021, compared to $586.6 million as of December 31, 2020 and $585.4 million as of September 30, 2020. Return on equity as of September 30, 2021 was 9.76% compared to 10.27% for the same period last year. Book value per share as of September 30, 2021 was $178.43, compared to $185.23 as of December 31, 2020 and $184.86 as of September 30, 2020.

First National Bank Alaska files a quarterly financial report with the Federal Financial Institution Examination Council. Our latest Consolidated Report of Condition and Income (Call Report) is filed by the 30th of the month following quarter-end and is subsequently posted at www.FNBAlaska.com > Financial Reports and at www.OTCMarkets.com.

Alaskan-owned and -operated since 1922, First National proudly meets the financial needs of Alaskans with ATMs and branches in 18 communities throughout the state, and by providing banking services to meet their needs across the nation and around the world. In 2021, Alaska Business readers voted the bank the “Best of Alaska Business” in the Best Place to Work category for the sixth year in a row. American Banker recognized First National as a “Best Bank to Work For” for the third year in a row in 2020, and Anchorage Daily News readers voted the bank one of the state’s top two financial institutions in the ADN “Best of Alaska” Awards in 2020. First National was also recognized as the most admired company in the state by MSN.com and received the Rita Sholton Large Business of the Year Award from the Alaska Chamber.

Visit FNBAlaska.com for more information about Alaska’s largest locally owned bank and access to efficient and secure online banking services. First National Bank Alaska is a Member FDIC and Equal Housing Lender.