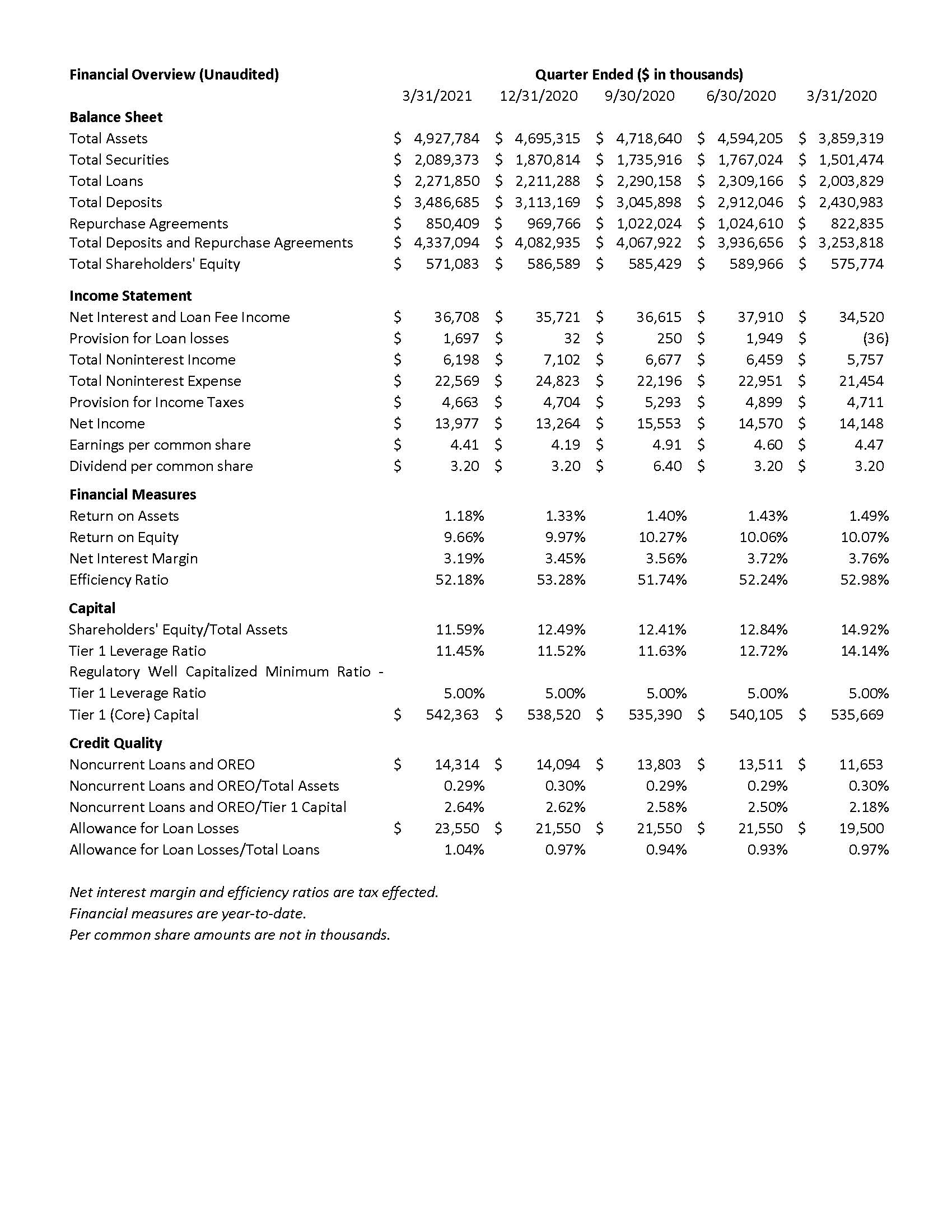

(ANCHORAGE) First National Bank Alaska’s (OTCQX:FBAK) unaudited net income for first quarter 2021 was $14.0 million, or $4.41 per share. This compares to net income of $14.1 million, or $4.47 per share, for the same period in 2020.

Total interest and loan fee income for first quarter 2021 was $37.1 million, an increase of 0.8% from first quarter 2020 on higher average earning assets. The blended yield on interest-earning assets decreased to 3.23% from 4.01% for the three-month periods ending March 31, 2021 and 2020, respectively. Variable loan repricing, the addition of Small Business Administration Paycheck Protection Program (SBA PPP) loans in 2021, and significant cash and short-term investments held for liquidity resulted in lower yields on earning assets. Net interest margin year-to-date moved to 3.19% compared to 3.76% during the same period 2020.

Noninterest income for first quarter 2021 was $6.2 million, as compared to $5.8 million for first quarter 2020. Excluding realized investment gains and losses, noninterest income for first quarter 2021 increased 11.0% from first quarter 2020 due to significantly higher mortgage loan origination income. Following the decrease in mortgage rates in March 2020, home purchase and refinance activity has been robust. Noninterest expenses for first quarter 2021 increased 5.2% when compared to first quarter 2020, primarily as a result of higher salaries and benefits. Yet the efficiency ratio for first quarter 2021 improved to 52.18% compared to 52.98% for the same period last year.

Total assets were $4.9 billion as of March 31, 2021, an increase of $232.5 million from December 31, 2020 and $1.1 billion from March 31, 2020. Return on assets through March 31, 2021 was 1.18% on a much larger asset size compared to 1.49% for the same period last year.

Deposits and repurchase agreements increased $254.2 million and $1.1 billion for the quarter and year-over-year, respectively. This increase was attributed to continuing PPP and CARES Act stimulus to governmental entities and Native tribes, increased savings rates of businesses and individuals, and continued growth from organic business development efforts.

Total loans increased $60.6 million and $268.0 million for the quarter and year-over-year, respectively. Contributing to the increase in loans is the bank’s participation in the SBA PPP. During the second round of funding in first quarter 2021, the bank originated more than 1,800 SBA PPP loans, totaling $182.7 million. Outstanding SBA PPP loans total $342.2 million as of March 31, 2021. First National’s SBA PPP borrowers have received forgiveness totaling $172.4 million through the end of first quarter 2021 on first phase loans.

At March 31, 2021, delinquent loans from 30 to 89 days were $4.9 million, or 0.26% of outstanding loans excluding SBA PPP loans. This represents an increase of $2.2 million since December 31, 2020. Nonperforming loans were $13.8 million, or 0.72% of outstanding loans excluding SBA PPP loans, up $0.2 million from December 31, 2020. The allowance for loan losses at March 31, 2021 was $23.6 million, 1.04% of total loans (1.22% of loans excluding SBA PPP). During first quarter 2021, a provision for loan allowance of $2.0 million was recorded in response to the pandemic-related slowdown in travel and tourism activity affecting certain commercial real estate loan participations.

Loan modifications as of March 31, 2021 totaled $269.8 million, or 13.97% of total loans, excluding SBA PPP loans. Modification to interest-only payments accounted for more than 94% of the modifications, with interest-only periods ranging from one to nine months. Modifications remain concentrated in commercial real estate loans to customers in the rental and leasing and hotel and food service industries.

“We are actively communicating every day with our customers across Alaska to monitor business conditions,” Said Betsy Lawer, Board Chair and CEO. “Their input reinforces our optimism that Alaska businesses are resilient and preparing for an economic recovery.”

Shareholders’ equity was $571.1 million as of March 31, 2021, compared to $586.6 million as of December 31, 2020 and $575.8 million as of March 31, 2020. Return on equity as of first quarter 2021 was 9.66% compared to 10.07% for the same period last year. Book value per share as of March 31, 2021 was $180.33, compared to $185.23 as of December 31, 2020 and $181.81 as of March 31, 2020. The bank’s March 31, 2021 Tier 1 leverage capital ratio of 11.45% remains above well-capitalized standards.

First National Bank Alaska files a quarterly financial report with the Federal Financial Institution Examination Council. Our latest Consolidated Report of Condition and Income (Call Report) is filed by the 30th of the month following quarter-end and is subsequently posted at www.FNBAlaska.com > Financial Reports and at www.OTCMarkets.com.

Alaskan-owned and -operated since 1922, First National proudly meets the financial needs of Alaskans with ATMs and branches in 18 communities throughout the state, and by providing banking services to meet their needs across the nation and around the world. In 2020, Alaska Business readers voted the bank the “Best of Alaska Business” in the Best Place to Work category for the fifth year in a row. American Banker recognized First National as a “Best Bank to Work For” for the third year in a row in 2020, and Anchorage Daily News readers voted the bank one of the state’s top two financial institutions in the ADN “Best of Alaska” Awards in 2020. First National has also been recognized as the most admired company in the state by MSN.com and received the Rita Sholton Large Business of the Year Award from the Alaska Chamber.

Visit FNBAlaska.com for more information about Alaska’s largest locally owned bank and access to efficient and secure online banking services. First National Bank Alaska is a Member FDIC and Equal Housing Lender.

###